Opportunity zones were created to promote economic development in low-income areas by The Tax Cuts and Jobs Act (TCJA) which was passed and signed into law on December 22, 2017. This allowed each state and territorial Governor the opportunity to designate no more than twenty-five percent of low-income census tracts as Opportunity Zones.

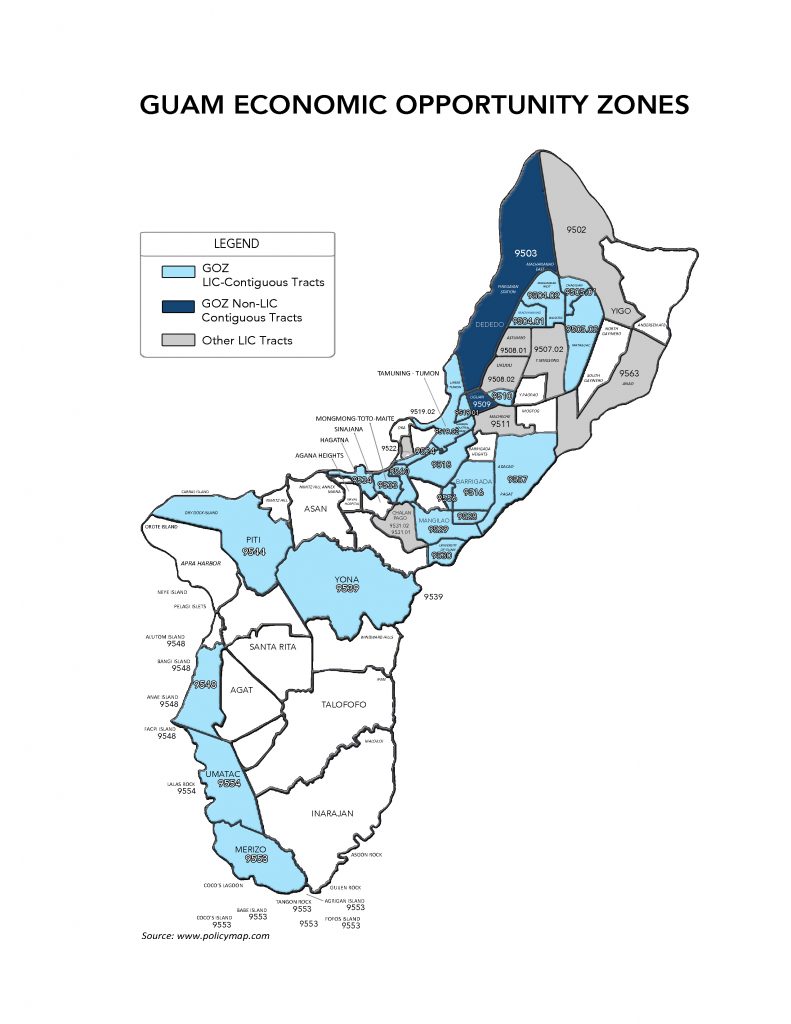

On April 19, 2018, the Governor of Guam identified twenty-five Qualified Opportunity Zones for Guam for both the Low Income Communities (LIC) and Non-LIC Contiguous tracts represented in the map attached. Further, the United States Department of Treasury certified these nominations for eligible census tracts. The TCJA serves as a critical tool to promote job creation and long-term investment for economically distressed communities, under certain conditions, to be eligible for preferential tax treatment.

Investments made in these Opportunity Zones allow for individual taxpayers who become self-certified through Qualified Opportunity Funds to claim tax benefits. These funds will be afforded a deferment in part or whole or an overall elimination of federal taxes on capital gains.

The Qualified Opportunity Fund becomes the vehicle for potential partnerships in investment in eligible Opportunity Zones. Individuals can take advantage of these tax incentives by simply investing in a Qualified Opportunity Fund.

The United States IRS supports the Community Development Financial Institutions Fund (CDFI) providing guidance for benefits on Qualified Opportunity Zones under IRC 1400Z-2.

For more information, please contact the Guam Economic Development Authority at 671-647-4332, www.investguam.com or visit the Community Development Financial Institutions Fund website www.cdfifund.gov for detailed information on the national program.

590 S. Marine Corps Dr.

ITC Building, Suite 511

Tamuning, GU 96913

Phone: 671-647-4332 • Fax: 671-649-4146

Monday – Friday, 8:00 am – 5:00 pm except Government Holidays