Per Guam Code Annotated (GCA) Title 12, Section 50103(k), the Guam Economic Development Authority (“GEDA”) serves as the central financial manager and consultant for the Government of Guam (“Government”) and those agencies or instrumentalities of the Government requiring financial guidance and assistance.

Such technical assistance by GEDA includes, but is not limited to, obtaining funds through bonds or other obligations, structuring such bond issuances, preparation and dissemination of financial and investment information, including bond prospectuses, development of interest among investment bankers and bond brokers, maintenance of relationships with bond rating agencies and brokerage houses and, generally, acting as the centralized and exclusive financial planner and investment banker for all the agencies and instrumentality’s of the Government.

Action by Congress and the President would be required before an oversight board could be established for any territory other than Puerto Rico.

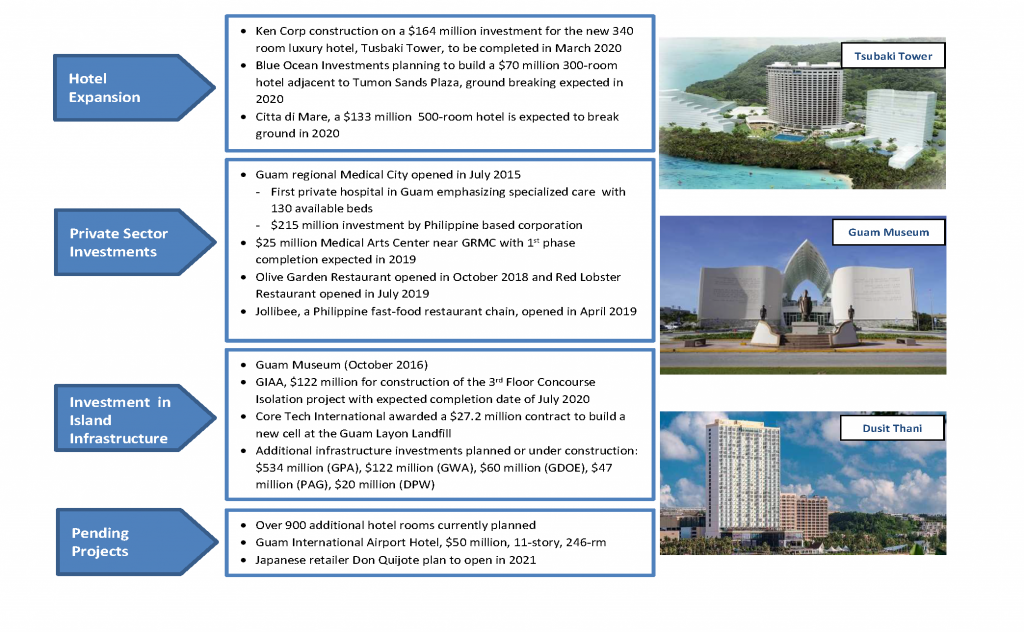

Recently completed projects demonstrate diverse economic development and provide a solid foundation for sustained economic growth.

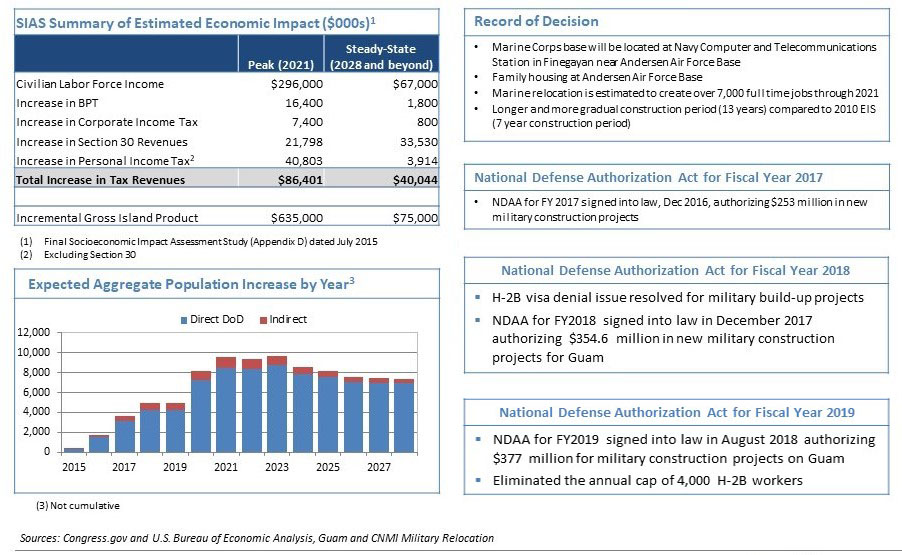

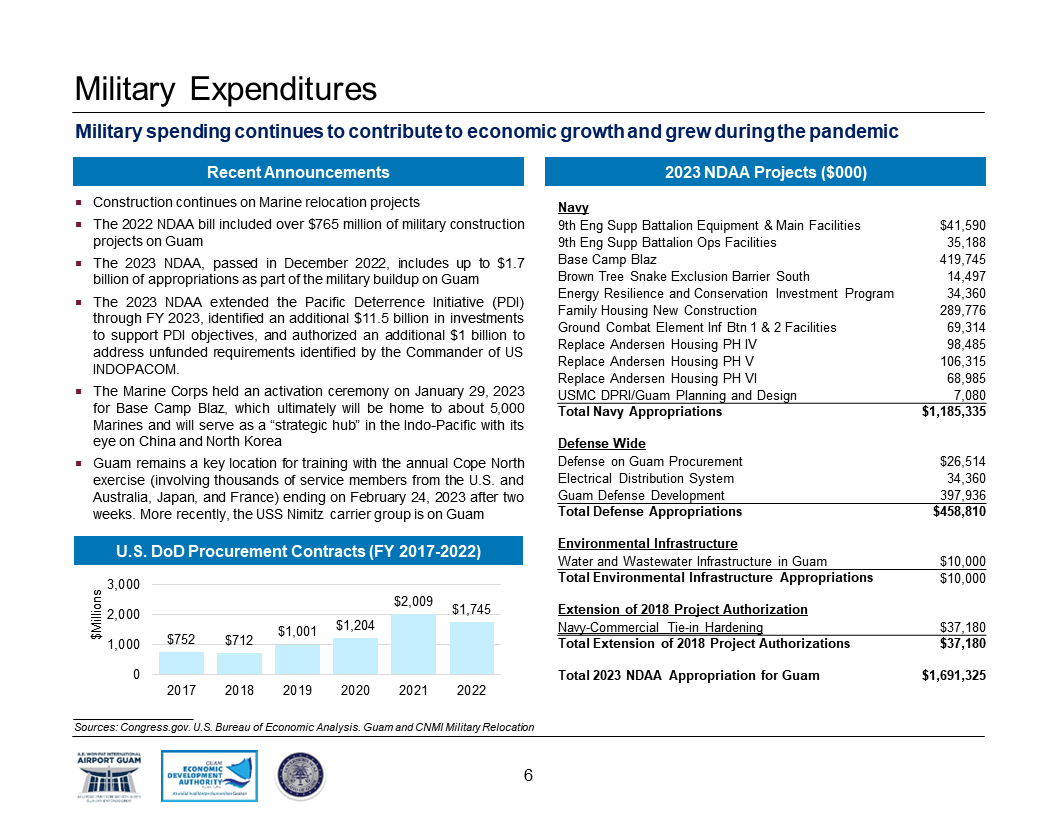

The signing of the Record of Decision (ROD) in August 2015 for the Marine relocation began the process for significant additional military investment in Guam.

590 S. Marine Corps Dr.

ITC Building, Suite 511

Tamuning, GU 96913

Phone: 671-647-4332 • Fax: 671-649-4146

Monday – Friday, 8:00 am – 5:00 pm except Government Holidays